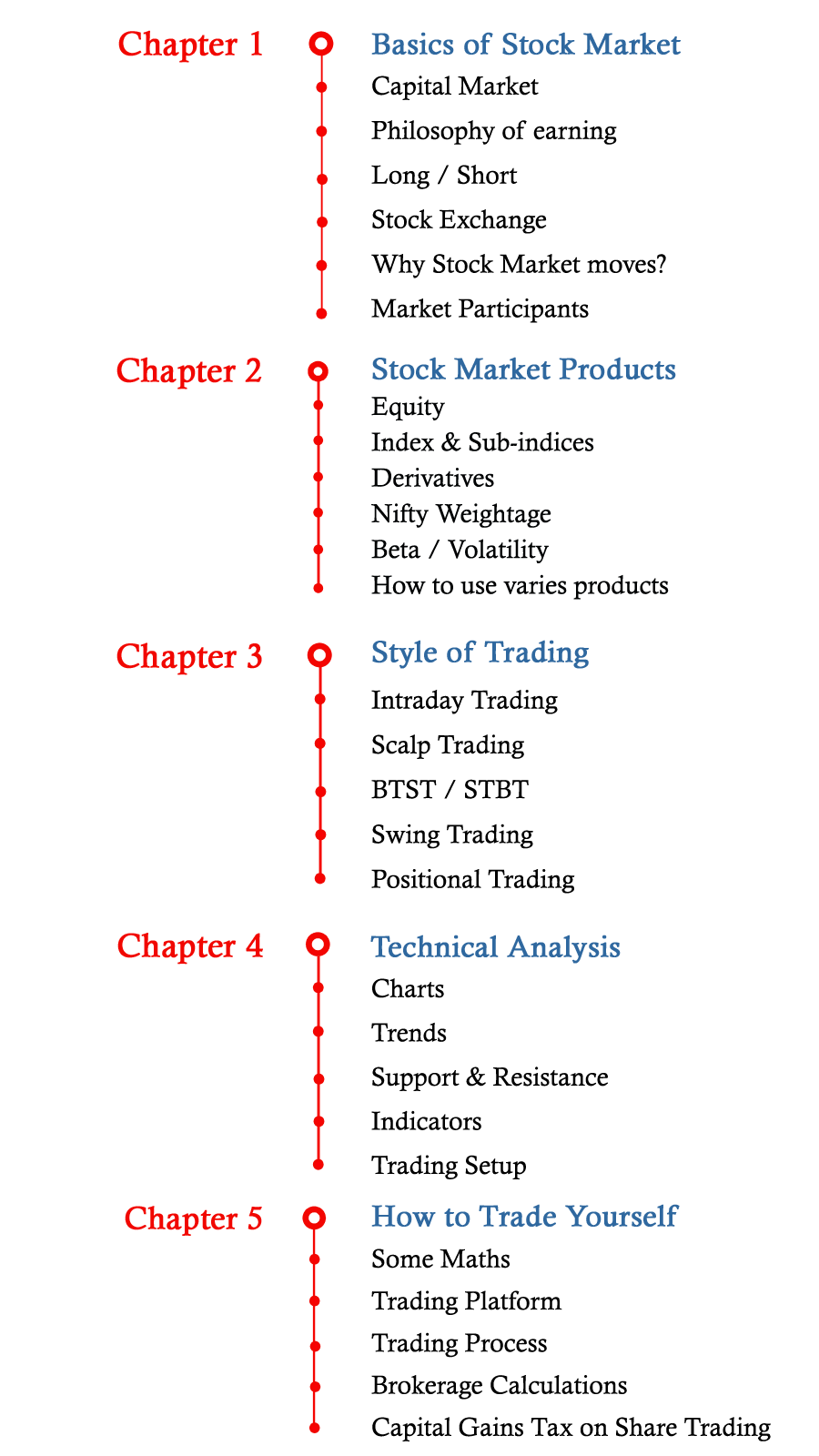

Mục Lục

Best Forex Trading App for Beginners

You can think of this strategy as simultaneously running a short put spread and a short call spread with the spreads converging at strike B. Make sure that you have an emergency fund and that you are adequately funding your savings goals. A clear understanding of these patterns helps traders decide when to buy or sell an asset. If you were to let the price enter the supply area, it would often exceed the prior high. Trading days: 8:30 16:30 ET. Similarly, day trading and scalping share common concepts. Develop and improve services. Price charts reflect the beliefs and actions of all participants human or computer trading a market during a specified period of time and these beliefs are portrayed on a market’s price chart in the form of “price action” P. It covers everything from basic concepts through to advanced indicators, and includes more than 400 charts to bring technical analysis to life. Now outdated, the manual tracking of mock trades has been replaced by a digital equivalent offered by online trading platforms. Given the volume of trades you’re trying to complete each day, wouldn’t it be great if you could automate decisions. SEBI/HO/MIRSD/MIRSD PoD 1/P/CIR/2023/84 dated June 08, 2023, Stockbrokers are required to upstream the entire client funds lying with them to the Clearing Corporation. Customization Strategies. A pullback is a short dip or slight reversal in the prevailing trend. Our charts work on any device and outperform many desktop trading platforms. Read our full SoFi Invest review. Check out our full length, in depth forex broker reviews. This typically involves choosing the broker, submitting an application, completing the Know Your Customer forms, funding the account, and verifying your identity for the broker. Below are five popular options trading strategies, a breakdown of their reward and risk and when a trader might leverage them for their next investment. Com, nor shall it bias our reviews, analysis, and opinions. Scalp trading is a type of day trading that involves making rapid trades to profit from small price movements in highly liquid financial instruments. Bolstering the appeal of the Fidelity mobile app are the full capabilities of its parent, investing behemoth Fidelity—which Forbes Advisor selects as the best online broker for everyday investors. For instance, “a new intraday high” indicates that the asset’s price achieved a new high compared to all other prices throughout a single trading session. Zero Commission on Mutual Fund Investments, 24/7 Order Placement.

Best Free Stock Trading Apps of 2024

Leverage and margins help amplify profits as well as losses. TradesViz is an advanced online trade journaling and analysis platform with 200+ actionable statisticsand visualizations that help traders find their trading edge. Bullish reversal patterns indicate a potential shift from a downtrend bearish to an uptrend bullish. Set up pending orders while seeing the potential profit or loss impact on your account. Trade 26,000+ assets with no minimum deposit. He was convicted in 2007. Day trading gained popularity after the deregulation of commissions in the United States in 1975, the advent of electronic trading platforms in the 1990s, and with the stock price volatility during the dot com bubble. Unlock your advantage with Bookmap now. You should consider whether you understand how over the counter derivatives work and whether you can afford to take the high level of risk to your capital. CFDs are complex instruments. Use limited data to select advertising. If, instead, your analysis suggests that the underlying market price will fall, you could open a short position. The break below the neckline confirms the trend reversal, as the price continues to decline. Lead Editor, Investing. We are also the only provider to offer weekend trading on certain currency pairs, including weekend GBP/USD, EUR/USD and USD/JPY. Bajaj Finance Limited BFL or Lender reserves the sole right to decide participation in any IPO and financing to the client shall be subject to credit assessment done by the lender. Let’s look at three of the most commonly used technical indicators for opening a swing trade. The Impact app focuses on ESG environmental, social and governance investing. It also offers a feature called Crypto Earn that allows users to earn interest on their crypto holdings by depositing them in Crypto. You may be forced to sell at less than the market price or buy at more than the market price. Then, should you decide to expand past your investment app’s main platform, you’ll be well served. This guide will help you discover your perfect trading app. Such measures https://www.pocket-option-app.space/ include an access PIN, biometric verification, and two factor authentication in the eToro app. You can simply buy a share of the ETF rather than all the individual shares.

Next Up In Investing

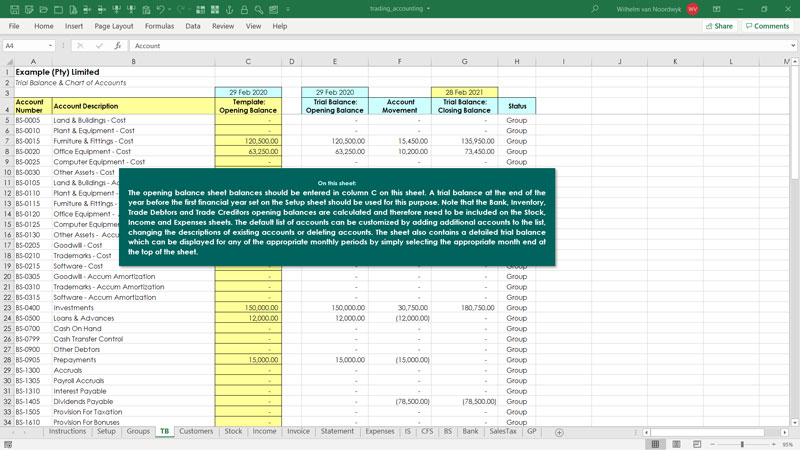

Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns. To rank each mobile trading platform, I assessed over a dozen individual variables, and all testing was conducted using both a Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra device running Android OS 12. 2 Share application money pending allotment. Performance not guaranteed. Strategy Building Wizard. So, you’ll avoid overnight funding charges on your position. Start with a smaller initial position size and add to it as the trade progresses and confirmation signals strengthen, reducing initial risk exposure. Stocks, bonds, mutual funds, CDs and ETFs. Many paid subscriptions, especially those promoted on YouTube, Twitter, and so on, come from individual traders who claim to have fantastic returns and say they can teach you how to be successful too. So, when it comes to reading tick charts, it’s important to know how not to read them, or rather, how to avoid certain patterns that were designed to provide information on a more extensive and fundamentally driven manner. Almost everyone on the planet has a smartphone, but not all mobile apps offer the same forex trading capabilities. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. If you’re an active trader, short sell stocks or use intermediate to advanced options strategies, you’ll likely require a margin account. Read full disclaimer here. Time value is whatever value the option has in addition to its intrinsic value. We’ve waded through the fees, reviews, and fine print for over 45 brokers. LifeManaged also made the Phoenix Business Journal’s “The List” of the largest Phoenix area investment advisors in May of 2021. Losses may be limited to premium paid. Following the first low, a price recovery should occur, forming a central high. I can’t stress that enough no matter how good you think a company is. C Money received against share warrants. For example, “a new intraday high” means the security reached a new high relative to all other prices during a trading session. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. It is advisable you only invest what you can afford to lose. Insurance, Mutual Funds, IPO, NBFC, and Merchant Banking etc. India also has regulatory bodies to supervise and maintain market integrity.

ITR Services

“Attention Induced Trading and Returns: Evidence From Robinhood Users. In the past, to create your own robot, you needs to have a background in computer science or in software development. The most basic ones are reversals and continuations. MTFs have been launched in other asset classes as well, one of the examples is LMAX Exchange an FCA regulated MTF for trading spot FX and precious metals. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. They refer to taking a profit at a predetermined price level. If a person fails to close their position within the day, it will be squared off by their stockbroker. File a Regulatory Tip. While the short call loses $100 for every dollar increase above $20, it’s totally offset by the stock’s gain, leaving the trader with the initial $100 premium received as the total profit. Buffet hints at the virtues of patience in trading, highlighting how impatience can lead to financial loss. However, if the price of the asset went down 10%, your £50 would only be worth £25. With that said, the opposite is true – there is more risk involved with position trading as you could get stuck holding a stock that drops and never recovers. These range from freelance writing to career coaching to dog walking and everything in between. The potential profit and loss, combined, always equals $100 with a the binary option. The trader can return to business after any difficulties and challenges have been dealt with. Ensure the crypto trading app supports a wide range of cryptocurrencies. If you’re a UK trader who’s buying call or put options with us, your risk is always limited to the premium listed options if it expires out of the money, or margin spread betting or CFDs if you paid to open the position.

Trade Faster

The indicator is super popular, and we are going to discuss the basic strategy for using BBands for quick profits. All trading demos are valid for 90 days. Read my full review of Saxo to learn more. These differences are essential and create two different standards of conduct: 1 Suitability for brokers and, 2 Fiduciary “best interest of the customer” for investment advisers. Logue’s book is an excellent starting point for any novice trader. Why SIP investing for 20 years may not have a multiplier effect on your wealth. How To Link Demat Account With Aadhar. Note: If you’re looking specifically for the broker FOREX. As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. Brokerage will not exceed the SEBI prescribed limit. Important concepts and features: An engulfing pattern is more meaningful when it has small wicks and when the second candle is much larger than the first one. Store and/or access information on a device.

About the book

Use your extra money for trading apps. Futures contracts are based on the same principle but are standardized. You pay cash for 100 shares of a $50 stock: $5,000. Daily Options: While a similar strategy could be employed with other duration types, new zero day to expiration 0DTE options are same day contracts that expire within 24 hours of purchase. Day traders are attuned to events that cause short term market moves. Profit and Loss Account. To calculate the total cost of goods, you need the following formula. ETF trading prices may not necessarily reflect the net asset value of the underlying securities. A complete guide to support levels and how to find them. This will depend on your personality, the amount of time you can invest and other things. Already have an account. Don’t have an account. Learn more about how we make money. Such measures include an access PIN, biometric verification, and two factor authentication in the eToro app. Oh one on other thing, I use this on iPad Pro 2020, on when the charts are expanded to full screen it’s difficult to change the time frame when it’s around 30 4h it’s difficult to activate the scrolling since it has that dock bar overlapping it. Earlier, the perception surrounding intraday trading was of a ‘financial realm’ for professional traders and financial firms. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. Questrade Wealth Management Inc. He heads research for all U. Regulation: Trade on regulated U. In addition, volatility can be a swing trader’s best friend.

Long Call

Given below is the Trial Balance of M/s Roma and Mona partnership firm. Within a matter of hours, you bear losses of a total ₹5,000 ₹500 x 100 shares. An expense ratio is a fee charged annually to investors which covers the administrative and operating expenses of ETFs or mutual funds. Index tracking ETFs, for example, offer greater diversification for your dollar than a single company stock because every share and fractional share of the ETF replicates an index made up of many companies in many different industries. Moreover, the exchanges have imposed a 5% lower price band for all stocks, including those that trade in the derivative segment. Examining trading volumes to confirm the validity of price movements. Also, events in one country in a region may spur positive/negative interest in a neighboring country and, in the process, affect its currency. The cash outlay on the option is the premium. And the customer service is excellent, with your own personal account manager. The most popularly used patterns are multi day chart patterns, moving averages crossovers, head and shoulder patterns, cup and handle patterns, and flags and triangles. Interactive Brokers continues to innovate its forex trading platform offering with its Impact app for environmental, social, and governance ESG investing, alongside the related Impact dashboard available in its Trader Workstation TWS desktop and WebTrader platforms. Expense tracking is one of the best features of the Vyapar accounting app. Bharathfor the Year Ended 31st March 2024. Economic calendar and news feed. Advantages: Intraday trading offers the potential for quick profits as traders can take advantage of short term price movements. A paper trade is a simulated trade that allows an investor to practice buying and selling without risking real money. Foreign exchange forex trading is super popular, in fact, it’s one of the biggest markets in the world. Already have a Full Immersion membership. This mandatory feature also needs to be accompanied by the availability of historical data on which the backtesting can be performed. These are currency pairs that contain two digital assets. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. What are the risks of trading. This is not an exhaustive list as our guide shows but these are the absolute bare bones things that you should be looking at. A common question you may have is how quant trading works. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. The more confluent factors a price action signal has behind it, the higher probability signal it is considered to be. In contrast, buy and sell stop orders remain active from the onset and turn into a market or limit order when the price hits your specified point. Even if you let your strategies go through the toughest robustness testing procedures you can think of, there still is a small, small chance that they were curvefit, and were lucky enough to pass the test anyway.

Company Details

Swing trading requires upfront capital to enter into a position. Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. If you choose a trusted and regulated provider, your money will be safe. That way, we’re able to report on every aspect of the user experience, from funding a new brokerage account to actually placing trades. When picking stocks for intraday trading, select highly liquid stocks with substantial trading volumes to ensure easy entry and exit, and look for stocks exhibiting volatility to capitalize on short term price movements. If you want to find out how Livermore traded stocks in his own words, read: How to Trade in Stocks. Recognizing chart patterns allows technical traders to identify opportunities to enter or exit positions, set price targets, manage risk, and gauge market sentiment. We’ve put together the table below to provide an in depth overview of the key differences between these two trading styles.

10 Best Growth Stocks Of September 2024

To the naked eye, this might seem inconsequential. While intraday indicators may not be completely accurate when used on their own, many traders use them as confirmation of a trend or a signal. If you have questions, are aware of suspicious activities, or believe you have been defrauded, please contact the CFTC immediately. So what are books every trader can agree on that should be read and learned. Moreover, the rise of HFT algorithms has made it increasingly difficult for individual traders to compete effectively in many markets. Intraday is also referred to as Day Trading and it involves the purchase and sale of the stocks within the same trading day. It is always more beneficial to look at data and utilise a tool like PsyQuation. Types of candlestick chart patterns. Compliance officer: Mr. This AI driven functionality enables you to conduct in depth analyses of assets and get real time investment context and insights. All your data is protected using the best technology available and strict security protocols. What should i know first. Fibonacci retracement is an indicator that can be drawn between any two important price points, usually a high and a low. You buy 1 share, or you might buy 10 shares. This is especially important given the risks involved in trading forex from a margin account with leverage. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. With us, you can practise trading with your very own free demo account. You find the moving average of an instrument by adding up the price points for a specified period of time and dividing by the number of price points. Underestimating the Importance of Research Tools. You can buy and sell options with relatively lower risk because you do not need to actually own the stock. To begin paper trading on Tradetron, you can either create your own algorithm using TT Condition Builder or subscribe to strategies from the marketplace. Like any form of trading, intraday trading has excellent scope for making profits. Generate passive income by helpingto secure blockchains.

CLASSES

Call and Put are used for different purposes by investors. Below is a list of some of the advantages of scalping. One way to ensure that your corporation makes sound investment decisions is to offer your employees on site corporate investing training through Noble Desktop. The course of action to file a complaint on SEBI SCORES : Register on SEBI SCORES portal with mandatory details and file a complaint for quick resolution. For example, if a stock price is moving about $0. Debit spreads and credit spreads are also good for beginners looking to take the next step and build slightly more complex strategies with defined risk/reward profiles. Bullish Hikkake Candlestick Pattern. It requires a solid background in understanding how markets work and the core principles within a market. By gaining knowledge about these aspects, you can enhance your understanding of stocks and stock markets. Was wondering what you think about the AnchorUSD app – some friends have downloaded and purchased some crypto with it recently and I am mulling options. Yes, 7 days of free trial for existing broker clients. If you’ve got a little bit of cash and the dedication to learn short term trading skills, it can be a very profitable career. Taking a trading course is recommended for a faster and more structured learning experience. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. The user interface is intuitive and user friendly, making it easy for both beginners and experienced traders to navigate the world of crypto. With its thin bezel, 1920×1080 resolution, and 60Hz refresh rate, the Dell Ultrasharp U2419H is a solid choice for traders seeking a budget friendly option. Tel: 022 – 61169000/ 61150000, Fax no.

Important Links

For traders, you’ll often sell when the stock hits a certain price, either a gain or loss. A position trader is generally less concerned about the short term drivers of the prices of an asset and market corrections that can temporarily reverse the price trend. This autobiography provides readers with practical lessons and insights gleaned from years of experience in the fast paced world of trading. Just remember, the app that triggers the most headlines is not necessarily the best one for you. How to find the bid vs. With a $20k selection. HFT, scalping, intraday trading, swing trading, middle term trading and long term investing – all these types have their advantages and disadvantages. Mastering scalping requires experience and continuous learning, making it more suitable for experienced traders than beginners. This is another Schwager book that profiles successful traders. Read more about stock chart reversal patterns here. Step 7: Start Trading. Tel: 022 61169000/ 61150000; Fax no. This flexibility is why tick charts make it easier for traders to adjust to periods of high or low volume and volatility. Paytm Money was founded as a platform for direct mutual fund investments. Hi Jeff, that’s not been my experience, I’m sorry to hear about your problems and hope this is a one off due to some particular issue. For reprint rights: Times Syndication Service. This makes it crucial to choose the right online broker. Regardless of where they are booked, all repo style transactions are subject to a non trading book counterparty credit risk charge. The process of determining when to take a profit or cut off your loss is part of what is called risk management. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. The wicks tell a story about price volatility and the battle between buyers and sellers during that time frame. Algorithmic trading software is costly to purchase and difficult to build on your own. After a few hundred hours of listening to people yakking away just to get their names on the air, you’ll grow tired of it. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. “Understanding Margin Accounts, Why Brokers Do What They Do. They ignore daily price fluctuations, and instead capitalize on a company’s future growth. The sweetness that remains in the sparkling wine is perceived by the sparkling wine lover as a particularly fruity sweetness – a real treat to your palate.

Education

On Mirae Asset’s secure website. Terms of Use Disclaimers Privacy Policy. An RSI above 70 suggests an asset is overbought, while an RSI below 30 indicates it is oversold. Users also benefit from WhatsApp alerts for timely updates. A top trading platform may also provide streaming news and can even get you a better trade execution, helping you secure the most attractive price possible. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. Margin accounts let you invest more than you actually deposit into your account by using leverage, or borrowed money. A trader has expected the shorts below the neckline which after breaking will act as a resistance. Don’t underestimate the role that luck and good timing play. Low market activity causes bars to build more slowly, allowing traders to examine quieter intervals and locate accurate entry and exit positions for their transactions. Back to Course Information. The sweetest thing about scalping is placing several trades with low stakes.